Goldman Sachs recently made a strategic investment in the French robotics firm Exotec. This move signals Goldman’s commitment to the robotics market and its potential for the future.

There are a few reasons why this investment is a wise decision for Goldman and this article will outline the benefits that Exotec offers.

What is Exotec?

Exotec is a robotics and automation company specialising in manufacturing solutions for businesses across the globe. Established in 2014, Exotec has sought to improve supply chain management efficiency with its Skypod Robots; mobile robots designed to automate warehouses, distribution centres and logistics operations by safely moving boxes without human labour. The company has R&D offices in Paris and Vivo, France and offices in Tokyo and Milan where it designs, develops and manufactures its robots.

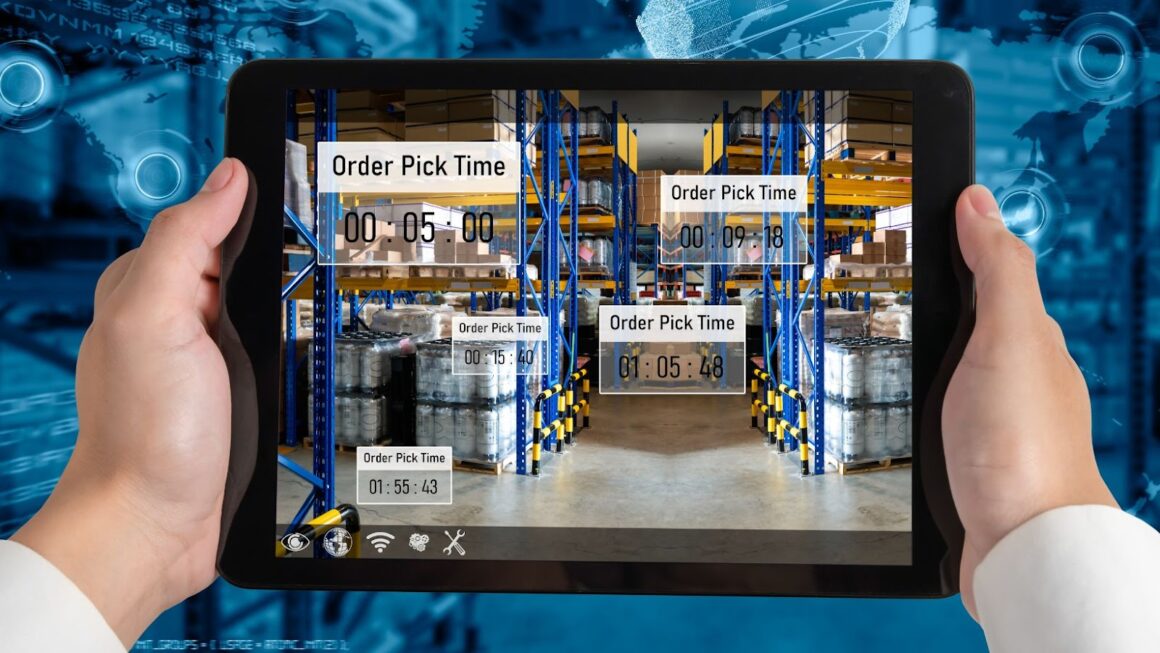

Goldman Sachs benefits greatly from its investment in Exotec by leveraging the proprietary software developed by the company’s engineers combined with advanced algorithms, enabling greatly increased operational efficiency. These programs monitor each robot’s progress through warehouses to ensure maximum warehouse management efficiency. Additionally, this program can further optimise procedures such as replenishing stock levels or organising product locations for quicker customer retrieval times.

Overall, investing in Exotec can provide Goldman Sachs long-term opportunities for exponential returns on investments through cost savings realised through Labor Reduction, Real Time Management Reporting, Improved Inventory Visibility & Reduced Error Rates.

Why Goldman Sachs is investing in Exotec

Exotec is an innovative and rapidly growing robotics startup that has successfully created a range of products for warehousing, distribution and retailing sectors. In addition, their price-performance ratio for their automated systems positions them as an attractive alternative to traditional solutions in terms of cost efficiencies and benefits in service delivery. Exotec offers impressive long-term profitability potential, making it a lucrative investment opportunity for companies like Goldman Sachs.

The core technology behind Exotec’s robots is both cutting-edge and highly modular, allowing businesses to scale their operations quickly and efficiently while maintaining complete control over operations and costs. Furthermore, Exotec’s robotics solutions are designed to fit the individual needs of different customers, meaning they can easily be adapted to business guidelines and productivity requirements with little effort or disruption. This makes Exotec a very attractive choice both from the point of view of cost savings as well as meeting customer demands on time.

In addition to these advantages, working with Exotec delivers significant environmental benefits too – their robots are designed with environmental goals in mind. Furthermore, they are completely electrically powered using renewable energy sources such as solar or wind power. As concerns about global warming continue to rise, this will increase future adoption rates for robotics solutions, providing investors like Goldman Sachs with long-term stability plans with lower carbon footprints.

For all these reasons – rising demand for cost efficiencies; flexibility & adaptability; loyalty & trust from customers; sustainable innovation – investing in Exotec has the potential to create value within Goldman Sachs’ portfolio over time; thus making it an ideal choice for strategic investors like them who are looking for innovative opportunities that will generate measurable returns well into the future.

Exotec’s Impact on the Robotics Industry

Goldman Sachs recently announced its investment in the French robotics firm, Exotec. As a result, Exotec has become a leader in the growing field of robotics. Through its innovative solutions, Exotec is changing how businesses operate and helping create jobs.

This article will discuss the potential impact Exotec could have on the robotics industry.

Exotec’s innovative solutions

Exotec is a pioneering robotics company redefining how goods are stored, managed, and delivered. Their innovative solutions have been successfully implemented in warehouses across Europe and Asia; these automated systems are designed to optimise packing, storage, retrieval, and delivery processes while reducing labour costs. As a result of their cutting-edge innovations, Exotec has increased the efficiency of warehouses by up to 200 percent.

The company’s groundbreaking warehouse automation algorithms can easily scale operations or ramp up during peak season. This scalability has enabled retailers to quickly adjust for fluctuations in demands-driven markets and maintain an agile supply chain for timely fulfilment of orders. Furthermore, Exotec’s warehouse management system offers valuable insights into the storage processes which can be used by retailers and logistics providers alike to further improve the efficiency of their operations.

Thanks to their state-of-the-art technologies and commitment towards enhancing customer satisfaction, Exotec is rapidly becoming a major player in the burgeoning robotics industry. They have already established partnerships with multiple major retail brands worldwide and are continuing to introduce new solutions that disrupt traditional warehouse logistics practices. By investing in Exotec, Goldman Sachs stands at the vanguard of robotics technologies; this exposes it to massive growth potential and ensures that it maintains a competitive edge within the contemporary market landscape.

Exotec’s potential for growth

In recent years, the robotics industry and its products have become increasingly prominent, offering businesses several opportunities to reduce costs, improve efficiency and diversify their operations. Exotec is an example of a robotics company with innovative solutions for the logistics and supply chain industry – their products automate warehouse operations through autonomous robots, which have proven efficient and cost-effective. Moreover, with robust funding from investors like Goldman Sachs, Exotec has demonstrable growth potential.

Exotec’s technology stands out in many ways: it enables warehouses to handle high volumes of orders quickly with limited labour; its robots are agile yet accurate in completing tasks; it offers customers an adaptable approach by leveraging smart shaping algorithms that improve performance with time; and most importantly, it increases safety by removing people from manual processes that involve carrying heavy objects or working in hazardous environments.

Exotec’s growth potential is further indicated by the 2020 Warehouse Robotics report highlighting how large warehouses often operate in silos due to lack of automation – up to 90% of warehouse activities rely on manual labour. Exotec’s innovations have enabled industries such as e-commerce and pharmaceuticals – sectors that must manage enormous amounts of product inventory – to automate entire warehouses within months. Furthermore, the success of their prior projects indicate strong prospects for Exotec’s continued technological development and adoption.

The increasing demand for automated warehouse technologies combined with continued innovation means that Exotec’s potential for growth is considerable. As a result, investment in this pioneering robotics venture may prove successful over the long term and provide allusions to other companies seeking entry into this growing market niche.

Goldman Invests In French Robotics Firm Exotec

Goldman Sachs has invested in the French robotics firm Exotec, which appears to be an investment likely to yield good results.

The Exotec technology is revolutionary, and their robots can take on tasks that were once considered too difficult or too dangerous for human workers. In addition, the potential for growth in the robotics sector is tremendous.

Let’s explore why Goldman Sachs should invest in the Exotec robotics firm.

Exotec’s potential for high returns

Exotec is a French-based technology company that has been operating since 2010. It specialises in robotics, artificial intelligence and Bluetooth technology, allowing it to develop innovative and automated solutions for warehouse management. Goldman Sachs is considering investing in Exotec due to its potential for high returns.

Exotec’s robotic platform offers diverse benefits, making it an attractive investment opportunity for Goldman Sachs. These include the following:

- Increased speed: Exotec’s robots can complete complex tasks quickly and accurately, reducing the need for manual labour. This can lead to increased productivity, lowered costs, and higher profits.

- Improved accuracy: Exotec’s robots have precise algorithms that allow them to make better decisions than humans in certain situations. This leads to fewer mistakes and increased warehouse or manufacturing facility efficiency.

- Advanced skill set: When integrated into a business’s existing infrastructure, Exotec’s robots can offer an advanced skill set by carrying out complex tasks not typically assigned to employees. This could be a valuable asset for businesses wishing to tap into new technologies and stay ahead of the competition.

- Autonomous navigation: The robots developed by Exotec have been designed with autonomous navigation capabilities. This allows the robots to autonomously navigate obstacles such as pallets, walls or other objects in a warehouse environment without needing human input or full control from an operator nearby.

Overall, Goldman Sachs can expect significant returns due to Exotec’s robotic platform being able to improve productivity while reducing costs while keeping up with the latest technological advances. Hence, customers remain satisfied – all factors that will make this an attractive investment opportunity in the future years ahead of us.

Exotec’s potential to expand Goldman’s global reach

Exotec is a Paris-based start-up known for its robotics sorting technology and logistics expertise. The company’s cutting-edge technology can help Goldman Sachs expand its global reach by giving it the capability to provide faster, more reliable delivery of products, parts and services to customers around the world. Exotec has identified key markets such as retail, manufacturing and aerospace where their robots can make the supply chain process smoother and more efficient. Exotec’s technology helps improve systems visibility, reduce mishandling of goods, decrease fulfilment times and cut costs significantly. Furthermore, with its advanced insights capabilities, Exotec allows firms to monitor inventory in real time to know exactly when restocking needs to occur, which could quickly move operations like shipping and custom processing across countries.

Investing in Exotec will allow Goldman Sachs to be involved in leading technological advancements across industries that it does business in globally. It also gives Goldman Sachs exposure to innovative companies making cutting edge products that will shape the future of logistics. In addition, it provides Goldman greater visibility into regions where logistics are expanding rapidly such as China and India where e-commerce could revolutionise delivery methods significantly. By leveraging Exotec’s abilities with their strategies, Goldman Sachs can continue their path towards becoming an industry leader in global investment banking and brokerage services.

tags = French warehouse robotics company, Exotec, Goldman, $335 million, Goldman Sachs Group, Inc, exotec 335m goldman sachs asset 2bsawersventurebeat, improve supply chain resilience for global retailers