The introduction of a Bitcoin ETF is supposed to be the beginning of a new era for cryptocurrencies, but traders are already jinxing it. Why do they think that’s going to happen? Or is it just their Wall Street instincts kicking in again?

The “bitcoin etfs” was announced on Wednesday and traders are expecting a sell-the-news event. According to the Wall Street Journal, traders have been weighting the potential for such an event.

With the launching of ProShares Bitcoin Strategy (BITO) on the New York Stock Exchange on Oct. 19, Wall Street welcomed the first Bitcoin (BTC) exchange-traded fund (ETF). On its first day, the fund drew more than $1 billion in trading activity, with the price of bitcoin rallying to a new high of $67,000.

However, the spot gains did not last long, as BTC pared some of its gains heading into the weekend.

On Saturday, the price of bitcoin fell over 11% from its all-time high to below $60,000, prompting concerns about selloffs that normally occur following the debut of big crypto derivatives products on Wall Street.

Analysts predict a larger BTC correction.

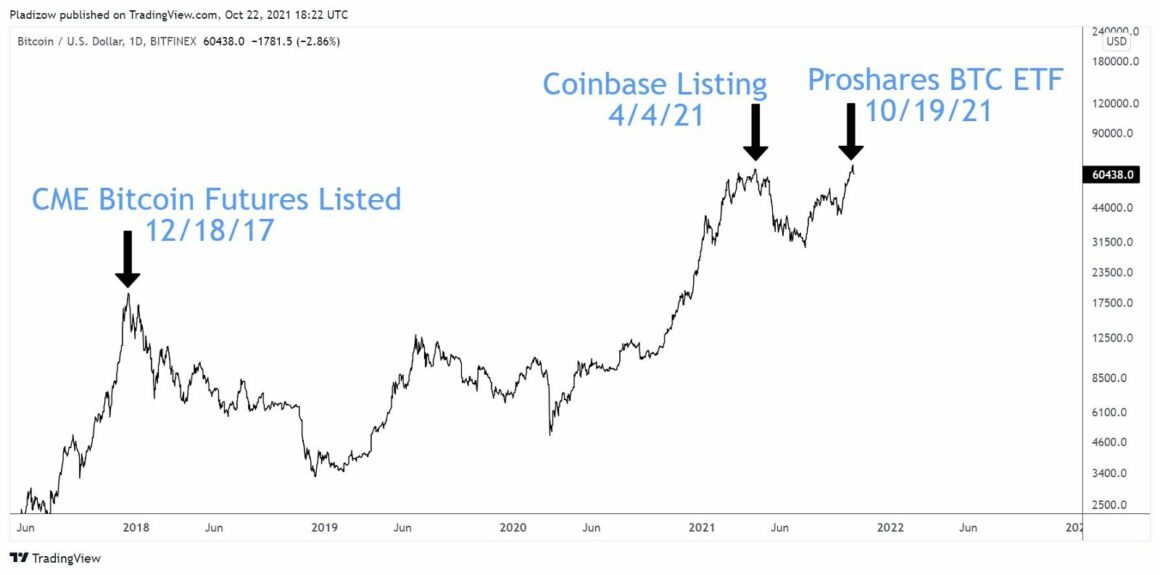

Nunya Bizniz, an independent market analyst on Twitter, remembered two such important events: the debut of the crypto trading firm Coinbase’s stock (COIN) on the Nasdaq stock exchange and the listing of the first Bitcoin futures on the Chicago Mercantile Exchange (CME).

Notable Wall Street listings occurred at the same time as spot Bitcoin price peaks. TradingView is the source of this information.

CME debuted its Bitcoin Futures product on December 18, 2017, the same day that Bitcoin hit a new all-time high of roughly $20,000. However, the introduction coincided with the start of one of Bitcoin’s longest bear cycles, which peaked at about $3,200 a year later.

Similarly, COIN’s Wall Street launch on April 4, 2021, coincided with Bitcoin’s rise to a new all-time high of nearly $65,000 only 10 days later. Despite this, the upward trend was greeted with a series of sharp selloffs, pushing BTC to correct to as low as $28,800.

God, no, no, no, no, no, no, no, no, no Please, God, don’t! No! No! Nooooooo! pic.twitter.com/ITKFBJqK6h

October 22, 2021 — Nunya Bizniz (@Pladizow)

As a consequence, Bizniz and many other experts are concerned about the so-called “buy the rumor, sell the news” correction as a result of the current ProShares Bitcoin ETF. Analyst Lark Davis, for example, said that he “wouldn’t be shocked” if the Bitcoin price drops after the introduction of the ProShares ETF, much as it did following the debut of the CME Bitcoin Futures.

CME futures on #bitcoin were announced on October 31st, 2017. – BTC is up 224 percent. – Launched on December 18th, the day BTC reached its all-time high in 2017.

I wouldn’t be surprised if the ETF launch went precisely as planned.

Buy the rumor, sell the news event image is epic. twitter.com/sKrmhdLxQv

October 8, 2021 — Lark Davis (@TheCryptoLark)

Additionally, Dan Morehead, Pantera Capital’s CEO and co-chief investment officer, said in a newsletter earlier this month that “he may want to take some chips off the table” ahead of the Bitcoin ETF’s introduction.

The Bitcoin ETF has had a strong start.

Despite the historically adverse sentiment associated with high-profile Wall Street crypto listings, some experts anticipate the Bitcoin ETF’s strong start will result in modest downward swings in the spot BTC market.

According to the Financial Times, Todd Rosenbluth, head of ETF and mutual fund research at CFRA, ProShare’s $1 billion launch is “a indication of the pent-up demand” among conventional financial businesses wanting to get a piece of the growing crypto market.

Retail traders accounted for just 12-15 percent of net inflows into BITO on the first two days of trading, according to JPMorgan Chase.

Bitcoin’s destiny is decided by the weekly close, which keeps BTC traders on their toes.

This indicated that institutional investors are interested in Bitcoin ETFs, as cash-marginated Bitcoin Futures open interest has risen by up to 79 percent month-to-date, and CME basis has risen from negative in July to over 16 percent this week.

Bitcoin futures have a lot of open interest on all exchanges. ByBt.com is the source of this information.

Bitcoin futures have a lot of open interest on all exchanges. ByBt.com is the source of this information.

Noelle Acheson, director of market research at crypto trading company Genesis, noticed that Bitcoin’s perpetual futures rolling basis, a measure for gauging leverage demand, increased somewhat but remained at 13.08 percent, down from 34.6 percent in mid-April.

High leverage has been a recurring theme in recent spot BTC market corrections. In other words, the current neutral funding rates signal that the risk of a large downturn is minimal.

The author’s thoughts and opinions are completely his or her own and do not necessarily represent those of Cointelegraph.com. Every investing and trading choice has risk, so do your homework before making a decision.

Related Tags

- can you buy crypto on fidelity

- invest in bitcoin now

- does crypto trade 24/7